Get rich tara tari

By Kamrul Khan

“TWO BROTHERS SENTENCED TO FEDERAL PRISON FOR OPERATING SHAM TAX PREP FIRM, STEALING NEARLY $500,000 IN CLIENTS’ REFUNDS.”

The above article is concerning on so many levels. First, regardless of their crimes, it’s difficult to see two young Bengalis, whose lives will never be the same and will have to go to prison, in a country their parents brought them to for a better life.

Second, and more concerning, is that the Bengali community in Philadelphia placed trust in them to carry out a task that sometimes seems too complex to understand. Let’s face it, when filing our taxes, the only thing most of us care about is the bottom line (will I receive a refund and how much?). As someone who has worked in corporate America for over 15 years, even I find filing taxes to be incredibly confusing, and draining. I can’t say that in the last 15 or so years that I have been filing taxes, that I’ve had a consistent accountant. I empathize with the Bengalis in the Philadelphia community who trusted these individuals that had promised them a large refund.

Now, here is a huge disclaimer: I am NOT in any position to give financial advice. I’ve made so many bad investment decisions that I tell people who ask me, to not follow what I do, and instead do the exact opposite. This post is not to give financial advice; it is to highlight a trend in our community that preys on vulnerable people with promises of short term riches.

I write about this because I see a trend of young Bengalis falling into this trap of get-rich-quick schemes. We can excuse our parents’ generation for relying on shady accountants like those in Philadelphia, but most of us that were born or raised here, should know better. So often, I see posts from young people asking how they’ve saved $10,000 and want to know what they should invest in to “double” their money. Many of the responses to these questions are to invest in risky investments that give you a higher chance to lose all your money than to make any reasonable gains. There is no investment that comes without risks. The greater the risk, the greater the reward. If there is an investment where you can double $10,000 in a short term, the risks associated with those investments are also great.

I also see unqualified individuals taking advantage of the young and vulnerable with promises of making fortunes and charging for their advice. The financial markets are a great place to build wealth, but it is also complicated and risky. Claiming that they are not, and not disclosing the risks of investing in the markets is incredibly dangerous. This is no different from unqualified “tax professionals” in Bengali neighborhoods that promise vulnerable new Bengalis large tax refunds. Tax fraud in the Bengali community is a huge issue as new Bengalis rely on these tax professionals to complete their returns without understanding that misstating and significantly exaggerating information on a tax return is fraud and can also lead to audits and fines by the IRS. We have a responsibility to call things like this out when we see it in the community.

If something sounds too good to be true, it probably is.

The concept of saving money for the future and building financial stability and a sustainable living is appealing, but then someone comes along with a get-rich-quick scheme and all of our financial common-sense goes out the window. Why is that?

Anyone that follows basketball knows that a significant percentage of NBA players lose their fortunes a few years after leaving the league. Some of you may be thinking that they spend it all on women, drugs, and cars. I’m sure there is some of that, but many of them fall prey to bad investments.

There are exceptions to the NBA players going broke trend:the biggest (lol) exception is Shaquille O’Neal a.k.a. the Big Aristotle a.k.a. Supernam a.k.a. the Big Cactus a.k.a.Shaq. In an interview, shaq talked about when he was entering the league and started to make millions. He interviewed a number of financial advisors. Many made the same grand promises to take his x amount of money and turn it into 40x by investing in things Shaq had no idea about and seemed too good to be true. Then he met an old accountant, who told him that he’d save his money into government bonds, set up corporations to shield some of his money for his family’s future. Many NBA players go with the flashy young Financial Advisors who promise to make them billionaires using “boutique” investment vehicles. That’s why many NBA players go broke.

If it’s too good to be true, it probably is.

Some of you may be thinking:

“Yea, but my friend made a fortune from Bitcoin. Haters like you would be putting him down too.”

“Oh, my friend has made a killing from investing in Penny stocks. He said I can also.”

You win. Some people have made fortunes from Bitcoin and Penny stocks–I know some of them. The honest ones will tell you that it was a fluke. Making 100 times your investment in a month, is not realistic. It may happen again, but that’s not investing. It’s winning the lottery. Far more people have lost money on Bitcoin. I don’t understand Bitcoin, but I do appreciate the technology behind it (Blockchain). Blockchain will change the world like the internet has. Penny stocks are essentially stocks that are not traded in the major exchanges (for a multitude of reasons), so you cannot research the company as much as you would a company that’s on an exchange. So, yes people have made money from them, but far more people have lost money.

I said this was not going to be a piece giving financial advice, the above paragraph may have crossed into that territory a little bit, but my point is that whenever someone promises you the world, it’s usually B.S. It’s always important to have your B.S. detector out when someone is flaunting that they took $40 and turned it into $24,000 in three days. That can happen, but it’s rare. If someone is promising you the world, be wary.

In a world where Donald Trump is president and minority communities are under a microscope, we have to be better than those tax preparers in Philadelphia. We have to call out scams, and those professionals who commit fraud in our community. It’s our responsibility to do so because, unfortunately, all the good our community does and all of our positive accomplishments are trumped by the news such as the fraudsters in Philadelphia.

Interview with Shaq:

Read More

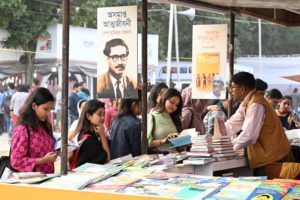

The Legacy of Boi Mela

Every year in February, the month-long national book fair welcomes...

Read MoreMillennial Amma: How to Explain a Global Crisis As a Parent

Rumki Chowdhury shares tips for how to talk to children...

Read MoreBegum Rokeya’s Millennials

A tribute to a pioneering Bengali feminist writer, educator and...

Read More